The industry is undergoing a very deep transformation process with the kindling of innovative Insurtech approaches alongside traditional models. Such a huge shift is restructuring the whole landscape, impelling a closer look at the dynamics that shape both worlds. We will then undertake an in depth comparative analysis aimed at unearthing the intricacies that define traditional practices of insurance and the very disruptions brought about by Insurtech. These two forces coming together are shaping the changes in ways that are influencing how insurance is perceived, consumed, and adapted to meet the ever changing needs of a dynamic market. These dynamics are important to understand by the industry players riding through the changing tides of insurance in the modern era.

1. Traditional Insurance Models

1.1 Legacy Systems and Processes

Traditional insurers have long leaned on established systems, providing stability but often impeding agility. Legacy processes, while time tested, face challenges in adapting swiftly to market changes.

1.2 Risk Assessment and Underwriting Practices

Traditional insurance relies on careful risk assessment and underwriting practices. It would, therefore, call for a detailed review of the risk landscape to inform appropriate policy terms and related premiums. Any such scrutiny of potential risks brings in an element of balance and informed approach to underwriting insurance covers that are suited to individual circumstances.

1.3 Customer Engagement and Service

In traditional insurance, customer relationships are forged through agents and intermediaries. This personalized approach is integral to customer engagement and service delivery, fostering trust through human interaction.

2. Insurtech Models

2.1 Technological Innovations

Insurtech transforms the norm with technological advancements Artificial Intelligence, Blockchain, and IoT. These state of the art technologies are the catalysts driving the journey of the changing landscapes of Insurtech, restructuring the notion, execution, and experience of insurance.

2.2 Data-Driven Decision Making

Insurtech is strongly dependent on the use of data analytics, which plays a major role in facilitating the process of decision making. To be more specific, it is about using data to tell more accurately about risk assessment, policy creation, and optimization of operational processes. The more data analytics used, the more an Insurtech player can serve their clientele by tailoring solutions, enhancing the management of risks, and streamlining operations requirements that will definitely change the insurance landscape into a more dynamic and responsive one.

2.3 Digital Platforms and Customer Experience

Maybe what differentiates Insurtech is simply that interactions with customers are often conducted on digital platforms. This digital first strategy takes a transformative effect on customer experiences, introducing heightened levels of convenience and accessibility. By adopting fresh digital solutions, Insurtech does not only modernize the interaction but also aligns with contemporary consumer expectations, hence setting up the basis for a much more efficient and user oriented insurance industry.

3. Comparative Analysis

3.1 Agility and Adaptability

With respect to traditional insurers versus insurtech players, one would look at their reactions to changes in the industry, regulatory changes, and changes related to emerging risks. One of the hallmarks of successful navigation in today's fast moving dynamics of rapidly changing insurance markets is to have the ability to adapt at speed.

3.2 Cost Efficiency

We examine the cost structures of both models with respect to how traditional insurers and Insurtech companies are treating operational expenses, distribution costs, and resource optimization. The resultant inference that naturally comes out of this is that cost efficiency becomes a metric of paramount importance for sustained success. How these entities manage and optimize cost structures will shed light on their preparedness and ability to sail through tough competition and offer value to customers efficiently and at economical rates.

3.3 Regulatory Compliance

On the other hand, the very forefront for insurers is regulatory compliance. The scrutiny of how traditional and insurtech models make their way through the complex insurance regulations landscape gives a perspective on their commitment to ensure not only compliance but also the observance of best practices. The close look underlines the aspect of regulatory framework compliance that serves to ensure industry players are guided by measures stipulated with high regard on operational integrity and observance of ethical standards.

3.4 Market Penetration and Reach

Market presence is a key determinant of success. Exploring the strategies employed by traditional insurers and Insurtech startups to expand their reach and capture market share unveils the varied approaches in a competitive environment.

4. Challenges and Opportunities

4.1 Challenges in Traditional Models

Traditional insurers encounter challenges such as slow digital adoption, resistance to change, and the need for modernization. Addressing these issues is pivotal for their sustained relevance in a rapidly digitizing landscape.

4.2 Challenges in Insurtech Models

Of course, this innovation is not without challenges for insurtech. Significant problems that need to be dealt with are data security concerns, uncertainty about supervisory authorities' reaction, and gaining the trust of customers in new digital channels. These issues would require to be navigated very carefully and strategically, taking care that insurtech entities create robust systems and comply with regulations in earning the trust to set themselves up in this vibrant insurance innovation landscape.

4.3 Opportunities for Collaboration

Knowing the strengths of both models opens the main line of inquiry into their potential for collaboration. Traditional insurers and Insurtech can enable a symbiotic relationship that unlocks unused potential. Such collaboration could support innovation, smoothen operations, and adapt to a resilient insurance ecosystem that would address the changing needs of the industry and its consumers.

5. Future Trends

5.1 Integration of AI and Machine Learning

Analyzing the trajectory of the industry, we explore how the integration of AI and machine learning will continue to reshape underwriting, claims processing, and customer interactions. The future is undeniably tech driven.

5.2 Blockchain for Security and Transparency

Blockchain has the power to enhance three most important aspects of insurance processes security, transparency, and efficiency. It offers promises to both traditional and Insurtech business models. Now, given this promise, it remains essential for players to understand how such a technology can be revolutionary. Since it's a trust bridging technology and a mechanism to streamline operations, it becomes critical for one to understand what it means for insurers in the quest for process improvement and remaining at the cutting edge of change in the industry.

5.3 Personalization in Products and Services

The future belongs to personalization in insurance. Traditional insurers and Insurtech alike are moving towards the personalization of products and services according to the needs of each customer. This is changing expectations from customers and norms across the industry.

6. Conclusion

The insurance industry is undergoing what might be the biggest transformation process, in which the traditional and InsurTech models are increasingly converging and influencing each other. Under such circumstances, it becomes very critical for stakeholders to identify the strengths and weaknesses inherent in both models. Embracing the future, success for insurance providers will be in a collaborative paradigm that would enable innovative ways to meet the constantly changing needs of the modern consumer with great agility. It is at the juncture of tradition and cutting edge technological innovation that we can find the catalyst for a sea change in this field. The crossing of these two areas will keep modeling the insurance world for many years to come by shaping this symbiotic relationship between the current challenges and opening up paths toward a resilient and adaptive consumer oriented future in insurance services.

Trending Posts

Global Silver Nanoparticles Market

The global silver nanoparticles market was valued at $2.08 billion in 2020, and is projected to reach $4.1 billion by 2027, growing at a CAGR of ~17%

LNG Bunkering – Here is something you must know!

In the current scenario of growing pollution, companies are trying to adapt more and more sustainable approach that not only gives eco-friendly result

The Basic Pension Comes - Federal Cabinet Decides On the Pension Supplement

Financial security in old age is an issue that is causing stomach pains for more and more people in Germany. Low-wage earners fear the elderly. The ba

The Future of Artificial Intelligence

In recent years, the field of artificial intelligence (AI) has witnessed unprecedented growth and transformative advancements. As AI technologies

Sailing into the future with Autonomous Ships

Autonomous Vehicles (AVs) are the uproar of this era. After airways, thanks to the companies like Tesla, that people are now getting used to see drive

Rising Demand For Uninterrupted Power Supply Is Expected To Drive The Power Rental Market

Todays world is totally reliant on electric power. There are many things which are not manageable without electricity. Power rental is a concept where

Rapidly growing IT industry coupled with the trend of bringing your own device (BYOD) is expected to provide new opportunities for growth of Cloud Collaboration

Cloud collaboration is the process of sharing and co-authoring the computer-based work through cloud technology

Factcheck on UV Disinfection for COVID-19

Many regulatory authorities and bodies believe that UV disinfection technologies can play a role in a multiple barrier approach to reducing the transm

The Global Ventilator Market Grows at a CAGR of 7.75 %

The Global Ventilator Market, which was at $688 million in the year 2016, is about to double by the year 2025, and reach a value of $1,347 million. Th

Vaccination: Vaccination Against Measles is Now Mandatory in Germany

The subject of compulsory vaccination has always heated peoples minds and caused emotionally charged discussions. The latest law in this area - the ob

Recent Posts

Growth and Future Trends of the Global In-Line UV-Vis Spectroscopy Market

In-line UV-Vis spectroscopy is a powerful analytical tool widely adopted in various industries for real-time monitoring of chemical and biological processes. This market is experiencing robust growth due to its applications in pharmaceutical.

Understanding the Growth Dynamics of the Premium Luggage Market

The market for premium luggage has grown massively over the years. This is attributed to several factors, including a change in consumer preference, increase in disposable incomes, and an overall rise in international travel.

Global Potassium Sorbate Market: Growth and Forecast

The Global Potassium Sorbate Market has gained significant traction due to the rising demand for preservatives across various industries, especially in food and beverages. Potassium sorbate, a salt of sorbic acid.

Global Venturi Masks Market Growth and Forecast

Venturi masks, also known as air-entrainment masks, play a crucial role in delivering a precise oxygen concentration to patients, particularly those suffering from chronic respiratory conditions such as COPD (Chronic Obstructive Pulmonary Disease).

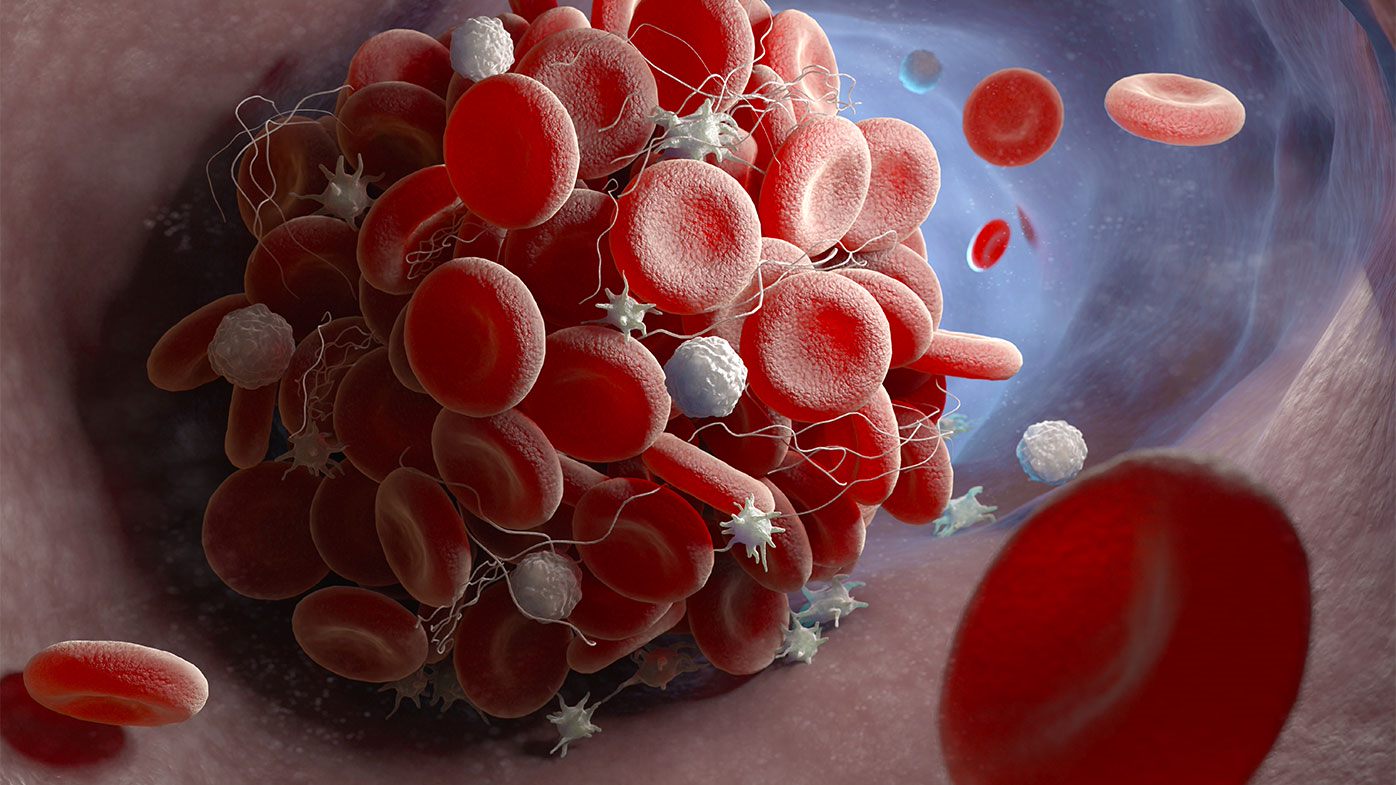

Global Venous Thromboembolism (VTE) Therapeutics Market: Overview, Growth, and Forecast

Venous thromboembolism (VTE) is a critical medical condition including deep vein thrombosis and pulmonary embolism. In fact, it is one of the preventable causes of death in the hospital environment. It has experienced a substantial upsurge.

Global Vein Illumination Device Market: Growth and Forecast

The global vein illumination device market is experiencing significant growth, Due to a growing demand for minimally invasive procedures and an increase in chronic diseases, not to mention development in medical technology.

Global Vasculitis Treatment Market: Growth and Forecast

Vasculitis represents a group of disorders involving inflammation of blood vessels. It can affect parts of the body such as the skin, kidneys, lungs, and joints, and without proper treatment it may cause severe morbidity.

Global Fired Heaters Market: Growth and Forecast

The global market for fired heaters is growing at a rapid pace due to increased demand from major industries such as the oil & gas, chemical, and petrochemical sectors. Fired heaters are among the most crucial components of process heating systems.

Global Gas Flares Market Growth and Forecast

The growth in oil and gas production, environmental regulations, and a need for an effective waste gas management system are driving the global gas flares market. Gas flares are a crucial equipment in the oil and gas industry.

Global Steam Reformers Market: Growth, Trends, and Forecast

The steam reformers market is witnessing significant growth due to increased demand for hydrogen in industries like chemicals, refining, and fertilizers.