This overview considers steps gone through in wealth management, an all encompassing advisory service bringing together financial planning and investment management, and goes through significant transformations driven by technological, changing consumer preference, and global economic shifts. This paper gives a comprehensive overview of the new trends in wealth management from a market research perspective to understand the evolving landscape of this dynamic industry.

1. Digital Transformation and Robo-Advisors

1.1 The Rise of Robo-Advisors

One outstanding trend in this reshaped wealth management space has been the rise of robo-advisors. Robo advisors are the use of computer based algorithms to provide automated financial advice and portfolio management. The platforms provide efficient and cost effective solutions, hence giving access to a wider population regarding wealth management services.

1.2 Hybrid Models for Personalized Services

While robo advisors succeed in making routine tasks automated, hybrid models are also emerging that connect the power of technology with human expertise, allowing for much more personalized and holistic advice in dealing with the requirements of clients. Technology and the human touch are coming together in wealth management to make sure there is a perfect balance between rich, personalized client experience and automation.

2. Data Analytics and Artificial Intelligence

2.1 Advanced Data Analytics for Personalized Insights

Wealth management firms are increasingly driven by data analytics while providing actionable insights into client behavior, preference, and market trends. Advanced analytics will allow advisors to offer clients more tailor fitted investment advice and financial plans based on large volumes of data. Predictive analytics is what feeds foresight into needs and market advancements for the implementation of proactive approaches to wealth management.

2.2 AI-driven Investment Strategies

Artificial intelligence plays a major role in the optimization of investment strategies. Machine learning algorithms analyze historical data, detect patterns within it, and adapt to market dynamics in real time. AI driven investment models optimize portfolio management through a continuous learning and adapting process to the market dynamics, providing more agility and responsiveness to wealth management.

3. Evolving Regulatory Landscape

3.1 Compliance Challenges and Technological Solutions

The wealth management industry is negotiating a very complex regulatory environment. Compliance requirements are changing continually. Firms are using technology solutions such as RegTech Regulatory Technology to make their compliance processes more efficient. Not only does the automation of compliance tasks reduce error risks, but it also ensures timely and effective updates on regulatory changes for a wealth manager.

3.2 Data Security and Privacy Concerns

The more wealth management embraces digital solutions, the greater the security and privacy concerns will be. Thus, firms make sure to invest in robust cyber security measures to safeguard information about clients and maintain the integrity needed for financial transactions. Blockchain technology is also gaining attention for its potential in general to enhance security through a decentralized, tamper proof ledger.

4. Customization and Personalization

4.1 Tailoring Services to Client Needs

The trend is one of customization because clients now have expectations of wealth managers providing personalized services. Now, wealth managers have taken a more holistic approach towards the needs of their clients in terms of their financial goals, risk tolerances, and preferences. Custom solutions enhance satisfaction and build long term relationships for the future.

4.2 Behavioral Finance Integration

Behavioral finance is increasingly becoming part of a more tailored approach to wealth management. If wealth managers know the way in which clients are making emotional and biased decisions about their finances, then they can guide them in a better way. Firms can provide strategies aligned with the client's financial personality by fusing data analytics with behavioral insight.

5. Environmental, Social, and Governance (ESG) Investing

5.1 Rise of Sustainable and Responsible Investing

This region has warmed up over the past years to ESG investing. Increasingly, more and more clients are educating themselves on the concept of ethical and sustainable investing. Wealth managers integrate ESG criteria into their investment processes and propose socially responsible portfolios that take into consideration environmental impact, social responsibility, and corporate governance.

5.2 Impact Investing for Social Change

Impact investing is that part of ESG investing that deals with positive social and environmental impacts, coupled with financial return. The growing demand for impact investing opportunities is one that wealth management firms are more and more beginning to recognize. This trend reflects a broader shift toward investments that contribute to positive societal and environmental change.

6. Client Education and Communication

6.1 Empowering Clients through Education

A new paradigm of relationships between clients and advisors, where an enhanced focus on educating clients, would be made, is emerging in the field of wealth management. Businesses invest in educational resources and means of communication so every client can acquire in depth knowledge on fundamentals of finance, investment strategies, and market dynamics. An informed client is better positioned to adopt prudent financial decisions, which may help in creating a collaborative type of approach in wealth management.

6.2 Enhanced Communication through Technology

Technology is an important element in enhancing the interaction between wealth managers and clients. With interactive dashboards, mobile applications, and online portals, a client is able to receive up to date information about his or her finances. Moreover, this communication becomes personalized through focused newsletters and webinars in order to keep in touch with clients and let them know about current market trends and new investment opportunities.

7. Globalization and Market Expansion

7.1 Global Reach and Cross-Border Wealth Management

Globalization is an arena in which wealth managers can fully take advantage of in order to reach diversified markets, each tailor made to meet the unique needs of their international clientele. The challenges emanate from the different regulatory environments of the jurisdictions involved, where a subtler and adaptive approach has to be taken.

7.2 Emerging Markets as Growth Opportunities

For the wealth managers, these emerging markets are fast becoming an attractive growth opportunity. The rise of affluence in these markets is associated with the increasing demand for sophisticated financial services, which provides opportunities to these wealth management firms in order to augment their clientele. Given this globalizing environment, success would seem to mean understanding the unique challenges and opportunities that come up in the new markets.

8. Conclusion

In summary, the changes that have emerged post-pandemic, mashing up the wealth management industry, are driven by digital innovation, data analytics, regulatory dynamics, customization, sustainable investing, client education, and globalization. It is the confluence of these trends that is shaking established paradigms and presenting unprecedented opportunities and challenges for the firms in the domain of wealth management. In this changing landscape, the manager of future wealth who will be successful is the one who fears no advance in technology but remains attuned to the needs of the client, agile, and prescient about the complex regulatory landscape. By understanding and adapting to these trends, WM professionals can place themselves at the forefront of a rapidly changing dynamic industry.

Trending Posts

Global Silver Nanoparticles Market

The global silver nanoparticles market was valued at $2.08 billion in 2020, and is projected to reach $4.1 billion by 2027, growing at a CAGR of ~17%

LNG Bunkering – Here is something you must know!

In the current scenario of growing pollution, companies are trying to adapt more and more sustainable approach that not only gives eco-friendly result

The Basic Pension Comes - Federal Cabinet Decides On the Pension Supplement

Financial security in old age is an issue that is causing stomach pains for more and more people in Germany. Low-wage earners fear the elderly. The ba

The Future of Artificial Intelligence

In recent years, the field of artificial intelligence (AI) has witnessed unprecedented growth and transformative advancements. As AI technologies

Sailing into the future with Autonomous Ships

Autonomous Vehicles (AVs) are the uproar of this era. After airways, thanks to the companies like Tesla, that people are now getting used to see drive

Rising Demand For Uninterrupted Power Supply Is Expected To Drive The Power Rental Market

Todays world is totally reliant on electric power. There are many things which are not manageable without electricity. Power rental is a concept where

Rapidly growing IT industry coupled with the trend of bringing your own device (BYOD) is expected to provide new opportunities for growth of Cloud Collaboration

Cloud collaboration is the process of sharing and co-authoring the computer-based work through cloud technology

Factcheck on UV Disinfection for COVID-19

Many regulatory authorities and bodies believe that UV disinfection technologies can play a role in a multiple barrier approach to reducing the transm

The Global Ventilator Market Grows at a CAGR of 7.75 %

The Global Ventilator Market, which was at $688 million in the year 2016, is about to double by the year 2025, and reach a value of $1,347 million. Th

Vaccination: Vaccination Against Measles is Now Mandatory in Germany

The subject of compulsory vaccination has always heated peoples minds and caused emotionally charged discussions. The latest law in this area - the ob

Recent Posts

Growth and Future Trends of the Global In-Line UV-Vis Spectroscopy Market

In-line UV-Vis spectroscopy is a powerful analytical tool widely adopted in various industries for real-time monitoring of chemical and biological processes. This market is experiencing robust growth due to its applications in pharmaceutical.

Understanding the Growth Dynamics of the Premium Luggage Market

The market for premium luggage has grown massively over the years. This is attributed to several factors, including a change in consumer preference, increase in disposable incomes, and an overall rise in international travel.

Global Potassium Sorbate Market: Growth and Forecast

The Global Potassium Sorbate Market has gained significant traction due to the rising demand for preservatives across various industries, especially in food and beverages. Potassium sorbate, a salt of sorbic acid.

Global Venturi Masks Market Growth and Forecast

Venturi masks, also known as air-entrainment masks, play a crucial role in delivering a precise oxygen concentration to patients, particularly those suffering from chronic respiratory conditions such as COPD (Chronic Obstructive Pulmonary Disease).

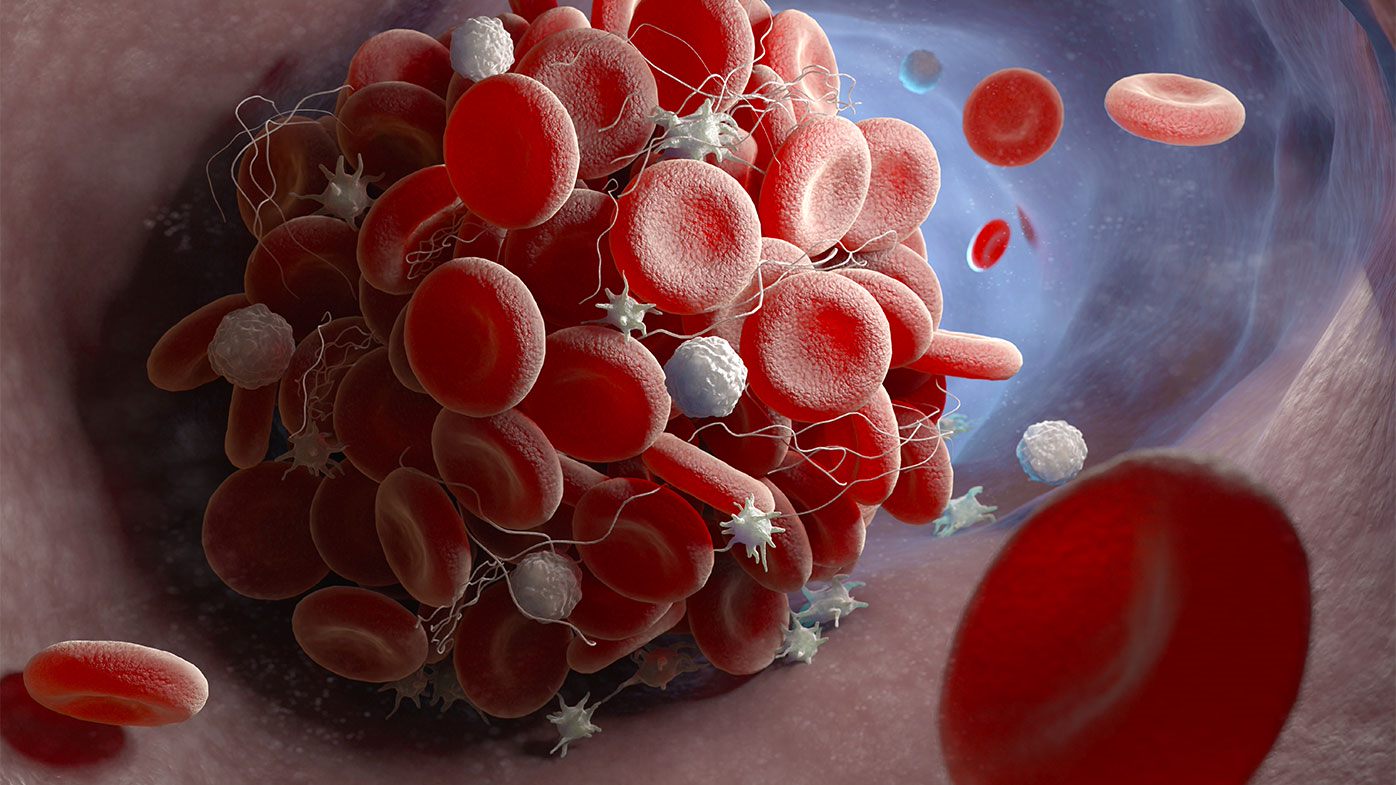

Global Venous Thromboembolism (VTE) Therapeutics Market: Overview, Growth, and Forecast

Venous thromboembolism (VTE) is a critical medical condition including deep vein thrombosis and pulmonary embolism. In fact, it is one of the preventable causes of death in the hospital environment. It has experienced a substantial upsurge.

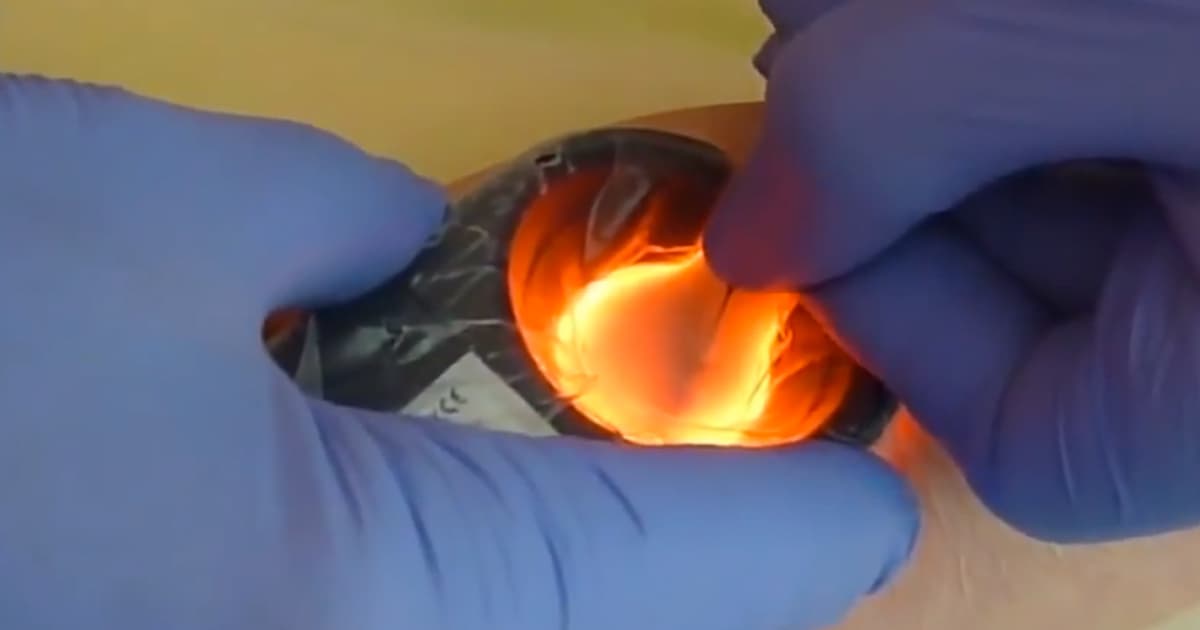

Global Vein Illumination Device Market: Growth and Forecast

The global vein illumination device market is experiencing significant growth, Due to a growing demand for minimally invasive procedures and an increase in chronic diseases, not to mention development in medical technology.

Global Vasculitis Treatment Market: Growth and Forecast

Vasculitis represents a group of disorders involving inflammation of blood vessels. It can affect parts of the body such as the skin, kidneys, lungs, and joints, and without proper treatment it may cause severe morbidity.

Global Fired Heaters Market: Growth and Forecast

The global market for fired heaters is growing at a rapid pace due to increased demand from major industries such as the oil & gas, chemical, and petrochemical sectors. Fired heaters are among the most crucial components of process heating systems.

Global Gas Flares Market Growth and Forecast

The growth in oil and gas production, environmental regulations, and a need for an effective waste gas management system are driving the global gas flares market. Gas flares are a crucial equipment in the oil and gas industry.

Global Steam Reformers Market: Growth, Trends, and Forecast

The steam reformers market is witnessing significant growth due to increased demand for hydrogen in industries like chemicals, refining, and fertilizers.